Life sciences companies are great at creating new life-saving drugs, like vaccines, specialty medications and more. But creating a new drug therapy for patients is only half of the battle. The other half is building relationships with key health care stakeholders to help drive better patient outcomes.

And guess what? One of the biggest contributors to building great relationships with healthcare professionals is giving them great, informative experiences with the pharma brand – which is why pharma digital hub platforms are more relevant than ever before.

Research from Bain and Company shows that at least two-fifths of physicians’ brand preference is attributable to customer experience factors beyond the product. These include, for example, how well pharma companies support physicians by providing answers to medical questions or connecting them with peers.

A successful life sciences company, then, will provide HCPs with the information they need – from access to information and key opinion leaders to ongoing support – to help drive better outcomes. There’s no better way to do this than through pharma digital hub solutions.

Yet, that’s why it’s worrying that physicians, according to Bain research, give pharma companies an average Net Promoter Score of -11 across all interactions.

The State of Digital Content in Life Sciences

It’s clear the pharmaceutical industry can do better. To start, they need to shift from simply pushing products to expanding the value proposition, becoming solution providers and proactive members of the patient journey. But are they ready to address these needs and be at the forefront of this transformation?

Well, the COVID-19 pandemic has forced the industry’s hand.

According to Accenture’s special report on COVID-19, the global pandemic has driven lasting changes in what healthcare providers need and value from pharma companies. Additionally, pharma itself has completely reworked how it connects and communicates with HCPs — with digital innovation, through the format of a pharma digital hub, being the primary driver.

How COVID-19 Changed Pharma’s Digital Presence

Here’s how things have changed:

-

- HCPs have seen a massive change in patient behavior, with 78% saying they saw a decrease in patient visits during COVID-19.

- Simultaneously, HCPs saw 36% of patients ask for telehealth options.

This one-two punch overwhelmed HCPs. In response, pharma companies changed their messaging from product information to support, with an emphasis on becoming a digital hub for HCPs. In particular:

-

- 69% of HCPs said digital patient education became more helpful.

- 68% of HCPs said pharma support services became more helpful than before COVID-19.

But pharma still misses the mark, despite the targeted introduction of pharma digital hub platforms. In fact, 58% of HCPs from Accenture’s survey say pharma companies spammed them with digital content and that the companies didn’t truly understand the impact the pandemic had on them and their patients.

While digital experiences have improved exponentially, the messaging and understanding of provider needs has improved only incrementally.

Why A Digital Hub Service Can Provide Better Insights and Results

The pharmaceutical industry knows it needs to change.

In fact, according to Accenture’s survey, 65% of all meetings during COVID-19 were held virtually and 87% of all HCPs say they want a mix of virtual and in-person meetings after restrictions are lifted.

To accommodate this shift to digital experiences, and to gain a better understanding of their clients, pharma needs to provide HCPs with digital hub services.

A pharma digital hub service is a centralized resource healthcare providers can turn to find not only the latest information on specialty pharmaceuticals, but also the latest information on techniques, developments in the field, and insights from key opinion leaders.

What A Digital Hub Is for Pharma

For life sciences, “digital hub” is a nebulous term. But for our purposes, these resources have a few characteristics:

-

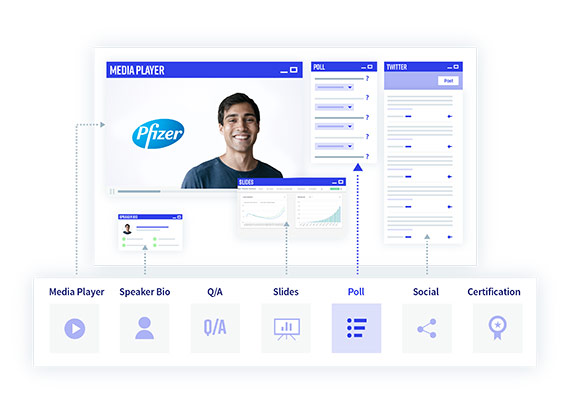

- First, they provide life science organizations with the digital technology they need to create. We’re not talking just about brochures and white papers, we’re also talking about webinars, podcasts and various other multimedia HCPs may consume.

- Second, they provide organizations with the tools to organize and deliver content to a specific audience. Often, this will mean creating hubs specific to HCP fields, but also providing HCPs with the ability to provide patient access to hubs specific to patient support services.

- Third, any hub needs to provide a pharma organization with the insights they need to optimize content and experiences for HCPs. That means tracking where HCPs engage, how long, what questions they ask, what trends they’re looking out for and more.

Armed with all of the above, a pharma rep makes a fundamental shift away from spamming a provider towards building a substantive long-term relationship.

What to look for in a Pharma Digital Hub Provider:

-

- Capability to create and host multimedia assets.

- Engaging digital environments, such as webinars and landing pages, that help build a buyer profile.

- Contained, self-service hubs that maintain compliance with regulations.

- Analytics to assess HCP and patient engagement.

Deliver a Patient-Centric Approach with Digital Solutions

HCPs primary concern is often the patient experience. That’s because better experiences are tied to better patient engagement and outcomes, according to the U.S. Department of Health and Human Services. As the market is shifting toward value-based, personalized healthcare, the demand for delivering patient services is also an important factor for pharma companies.

These services range from helping patients better understand their disease and how they can manage it, to helping them adhere to treatment plans and connecting them with others affected by the same condition. Many of these services can be centralized into the form of a pharma digital hub with ease, easing the strain on healthcare providers and patients alike.

Examples include AstraZeneca’s Day-by-Day coaching service for patients recovering from a heart attack, providing a combination of digital content and one-to-one coaching, and the dedicated social network for heart failure patients and caregivers launched by Novartis.

Despite the increase in both demand and supply, Accenture research revealed there’s a significant communication gap as just one in five patients are aware of these services, which, unfortunately, would render a pharma digital hub useless. Around half of HCPs reported that they hear about patient services less than 25% of the time from sales reps or through other channels.

If HCPs don’t have a good understanding of what’s available, they’re not likely to make recommendations to patients.

Life science organizations need to fill all these communication and information gaps by focusing the conversations with HCPs and the rest of the market on outcomes rather than products. They should strive to become trusted sources of scientific information, comprehensive data and peer-reviewed evidence through their digital hub platforms, not just providers of prescribed substances or medical devices and technology.

Ultimately, they need to help both the healthcare provider and the patient have a better conversation and identify the best possible care approach. Improving health outcomes is a responsibility that all players in the life sciences industry share.