In the past, asset management companies used face-to-face events to maintain expertise, spread influence and establish themselves as trusted experts. But the digital age has changed how knowledge-based organizations communicate and ply their trade.

Central to this transformation are webinars, software which empowers brands and thought leaders to bring human interactions to a digital scale. With asset managers webinars and similar virtual event technologies, asset management companies can easily produce events like:

-

- Summits and symposiums

- Outlook briefs

- Panel discussions

- Virtual conferences

- Focus groups

Without having to leave home, rent space or spend money on traditional event expenditures.

But what do these digital events actually look like? We’ve scoured our asset management customer webinars to find out what events they’re running and why. Here are the five most popular asset management webinars programs we found.

1) Global and Sector Outlooks

Asset management webinars share market conditions and outlooks with investment communities. It’s an opportunity to promote a firm’s expertise, build thought leadership with advisors and create stickiness with clients.

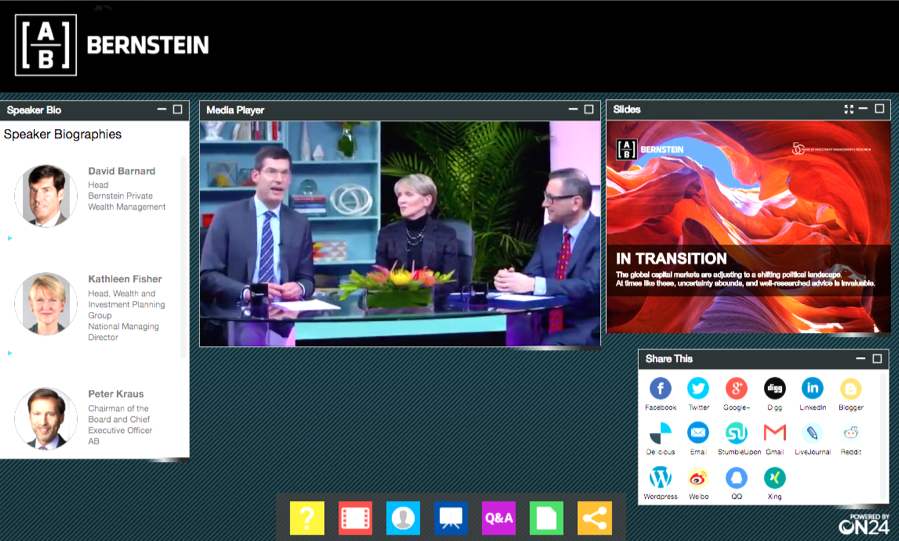

To help validate predictions, firms can use asset management webinars to showcase insights from investment advisors, portfolio managers and economists. To promote engagement with attendees, firms can open up the event’s Q&A to let attendees ask any questions they may have.

Event producers can, and should, also craft interactive webinar consoles. With engagement tools strategically laid out, firms can link to further research, provide calls-to-actions linking to specific funds and influence investments without pushing products.

Offering global and sector outlook events is a great way to connect with audiences in a more meaningful way than a simple report.

2) Fund Updates

Fund updates are an important part of any asset management operation. But too often these updates are shared through one-way content that lacks insights into audience interest.

For example, email-based newsletters share a firm’s insights, sure, but they’re easily ignored or lost in an inbox. Not only that, but firms also miss out on what engages and interests investors.

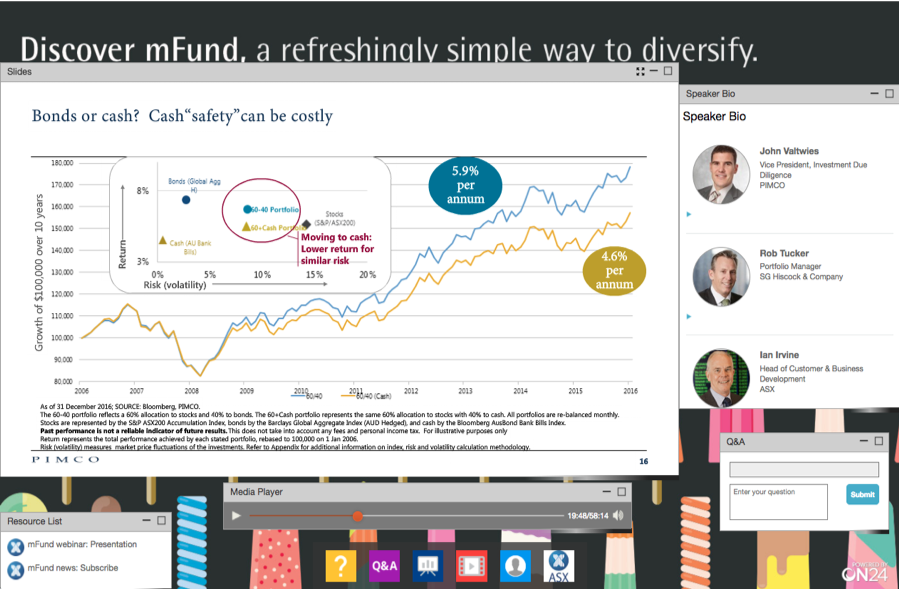

Webinar program in place, firms can show performance metrics while providing color around the data points and open up the conversation for questions and answers directly — in addition to capturing an audience’s full attention. After all, webinar series asset management processes can engage audiences more effectively than newsletters and other one-way communication formats.

3) Fund Launches

With digital fund launches, asset management companies can announce new funds in an engaging, scalable and personable way.

By engaging investors upfront through asset management webinars and virtual events, firms can more easily overcome any hesitation an advisor has in investing in a new product. That’s because a firms’ experts can respond to questions in real-time, provide resources on new funds and remove any barriers holding investors back.

Asset managers webinars also provide advisors with all of the relevant content you’ve created in support of a fund, including presentations, reports, videos and interviews. Post-event, you can use webinar data to discover who is most interested and direct your sales team appropriately.

4) Provide Continuing Education

Workers in the knowledge economy must keep up with the latest trends, innovations and industry lessons. But taking time to travel to attend conferences or workshops and gain continuing education credits is expensive and disruptive.

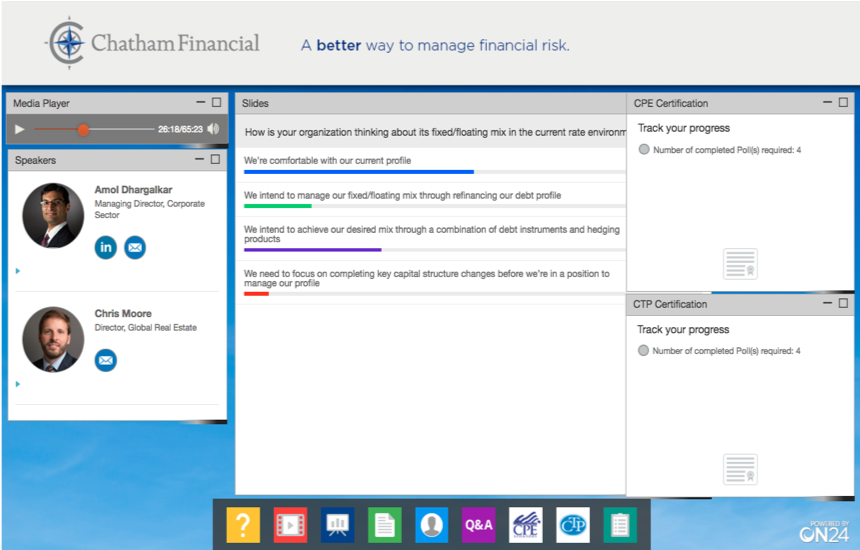

That’s where digital experiences come in. Asset management webinars and virtual events provide firms with the ability to publish lessons and issue continuing education credits.

In fact, with ON24, a firm can offer full or partial CE credits and auto-generate certificates after attendees complete standard governing body requirements. These can include tests, required viewing time and more.

5) Knowledge Centers

Firms produce a lot of content, including accompanying reports, articles, videos, webinars, podcasts, infographics and much, much more. Aggregate this content into content hubs where advisors can binge on the information most relevant to their needs and interests.

You can create specific content hubs for unique clients, topics or CE-accredited webinars. Collect data on every piece of content a person watches, what they did, what they downloaded and how long they watched asset management webinars or spent on a piece of content.

To see peer examples and hear a deeper explanation into these programs, check out the webinar Digital Engagement for Asset Management Marketers.