Overview

-

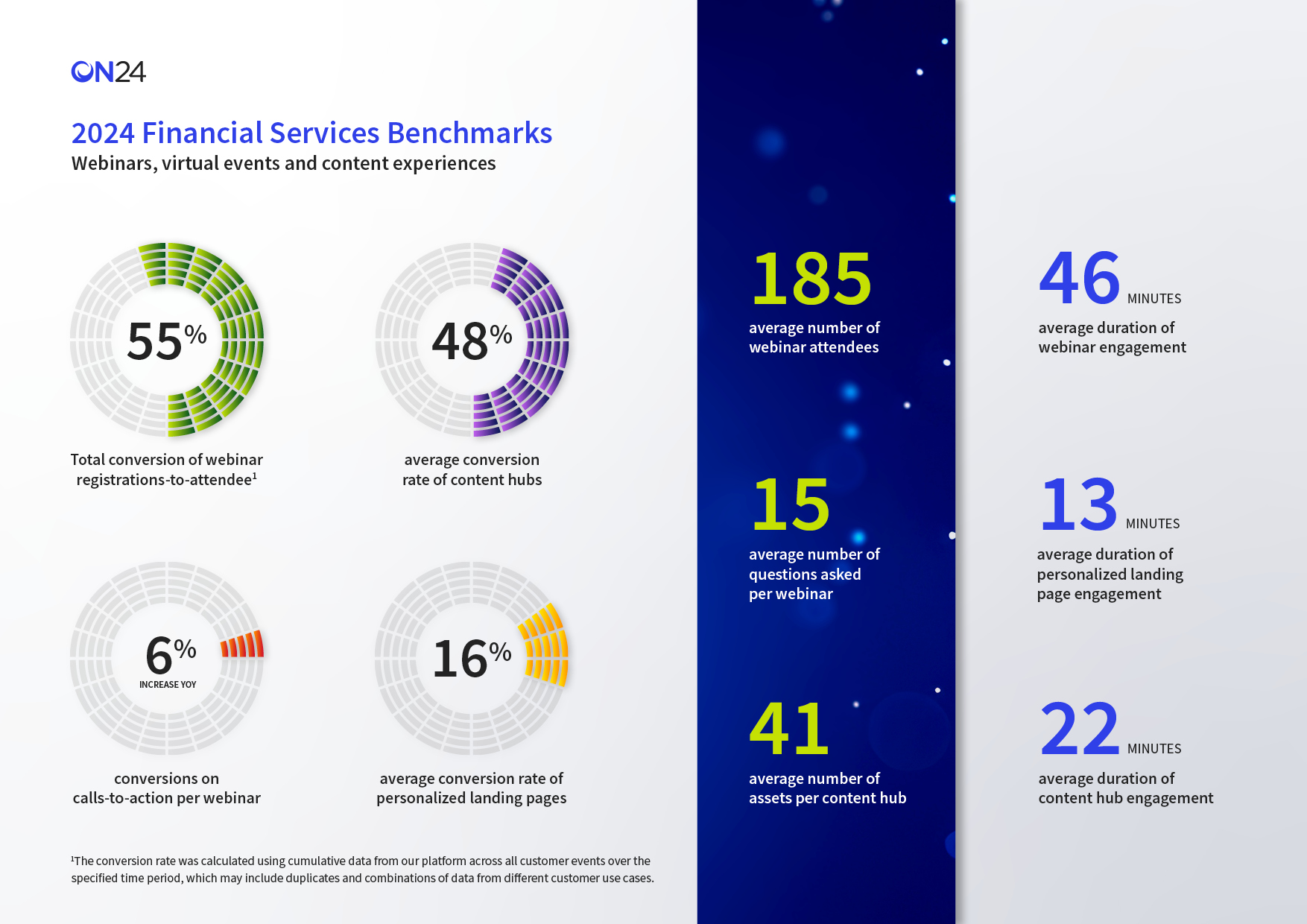

Increase in CTA conversion rate

6% increase in conversions on CTAs per webinar

-

Increase in Content Hub conversion rate

48% average conversion rate of content hubs

-

Increase in Nurture Page conversion rate

16% average conversion rates of personalized landing pages

Digital marketers in the financial services industry face a lot of competition for attention. From other institutions to social media, driving meaningful engagement and building trust with audiences is only going to grow in importance.

But how can financial marketers make digital engagement a reality?

That’s the question we sought to answer in our 2025 Financial Services Digital Engagement Benchmarks Report. In it, we explored how financial marketers leveraged webinars, content hubs, landing pages and holistic digital experiences in 2024 and what those trends means for marketers in 2025.

Here’s what we found:

Why Webinars Attract and Engage High-Value Audiences

Webinars provide financial marketers with a reliable tool to attract, educate and engage high-value audiences. And these audiences demand these events. In fact, according to our benchmarks report, financial services webinars saw:

-

- An average of 185 attendees per event

- A 6% increase in average viewing time

- A 22% increase in CTA clicks from a webinar

- A 26% increase in meetings booked from a webinar

That’s because webinars provide financial marketers the tools they need to provide both engaging information to attendees and the means to help high-value attendees to continue the conversation with the brand.

Why Webinars Deepen Overall Digital Engagement

Webinars are helping financial services audiences to become more sophisticated with how they engage with a brand. That’s because webinars provide audiences — and digital marketers — with a variety of interactive tools that enable deeper engagement. Our report found that:

Attendance at breakout sessions, which empower brands and audiences to directly engage with each other over video and audio in a webinar, increased by 2.7 times year-over-year.

Survey participation in financial services increased by 6%, outpacing all other industries.

The average number of unique interactions per webinar — from Q&A to poll responses, downloads and more — approached 300 for financial services.

All of these different interactions add up to something special: a wealth of first-party data that firms can use to refine their messaging, create hyper-personalized digital experiences and drive measurable revenue to the organization.

Why Finance Marketers Should Combine Webinars with Content Hubs

Webinars are never one-and-done events. The experiences and the content they contain can be repurposed, reused and reshared for on-demand consumption. The demand for on-demand content in the financial services industry increased by 14%, according to our report, indicating a rise in asynchronous content consumption.

Data from the ON24 Intelligent Engagement Platform’s Content Hub capability underscores this point. According to our report, we found:

-

- Resource downloads per visitor increased by 79% year-over-year

- Free trial and consultation requisitions increased by 60%

- “Contact us” requests rose by 51% for financial services, triple the rate of other industries

What this means is that content hubs are becoming a powerful tool for nurturing and converting visitors, tools that are fueled by webinar activity.

Why first-party data builds better personalized experiences

Personalization is a necessity in any high-performing digital marketing operation. However, to create bespoke, customized experiences for every stage of the buyer’s journey, marketers must make effective use of first-party data. To obtain high-quality first-party data, you must create engaging experiences.

Fortunately, financial marketers are rising to the occasion. Creating and publishing personalized experiences has driven significant results, with our research finding that personalization has:

-

- Driven a 3X increase in the number of registrations for upcoming webinars

- A 69% increase to the number of personalized pages YoY

- A 2.7X growth in downloads per personalized page

- A 53% uptick in resources downloaded per visitor to a customized landing page

Why Financial Marketers Are Adopting AI for Their Campaigns

You can hardly have a conversation in marketing today without mentioning AI. This remains true for marketers in the financial services sector. The reasoning is simple: AI tools enable marketers to both scale and personalize their digital engagement efforts.

For example, our report found that financial services organizations grew their use of AI to auto-generate promotional copy — which includes emails, landing page headlines and social media posts — by 2.5 times over the previous year. Not only that, but the use of AI to generate longer content, like e-books, blogs and key moments from webinars, grew by 4.6 times.

Ad-hoc requests for AI-generated content also grew in 2024 by 80%, suggesting that financial services marketers are looking for new ways to meld AI tools into their workflows.

Marketers working in the financial services industry are navigating a competitive landscape. But the right engagement strategies, paired with AI-generated content and insights, can provide teams with an advantage. To learn more about how you can gain a competitive advantage, check out our 2025 Financial Services Digital Engagement Benchmarks Report or register for a demo today.

Infographic