The past decade has changed the nature of the financial services industry. New services are entering the market with new models at a lower cost of entry compared to traditional firms. Established communication channels with clients — such as mail and face-to-face conversations — are falling out of favor. For traditional firms, however, one constant remains consistently true: digital marketing for financial services needs an upgrade.

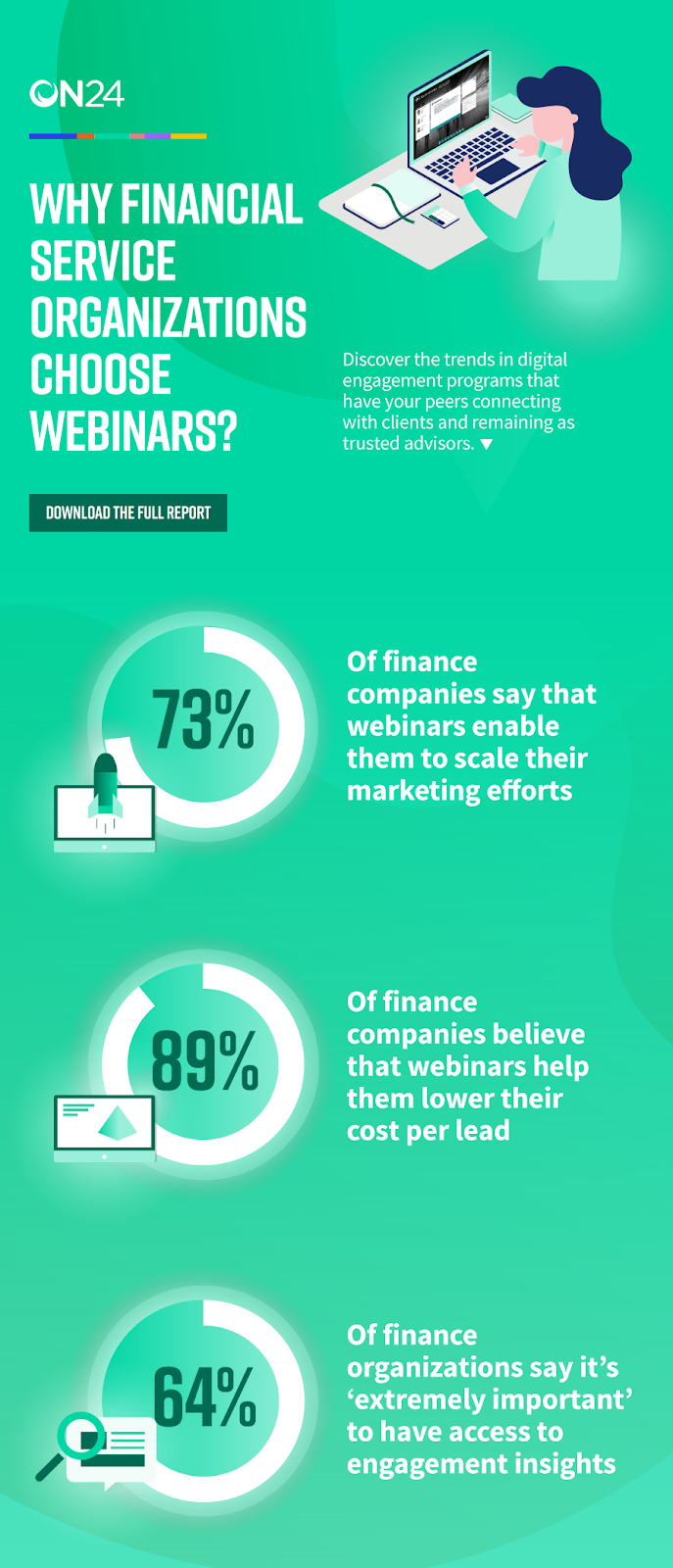

There are a lot of tools out there that can help, but there’s only one that provides a practical, immediate upgrade: webinars. According to ON24 research, 89% of financial services comapanies say webinars help lower cost-per-lead. An additional 73% of these organizations say webinars empower them to scale their marketing efforts. Sixty-four percent also say it’s ‘extremely important’ to have access to the engagement insights webinars provide.

Curious about what goes into a successful financial services webinar? Check out ON24’S 2019 Webinar Benchmarks Report for Financial Services.

But digital marketing for financial services is more than just webinars. Over the past few weeks, we’ve delved into what, exactly, digital marketing has changed in the financial services sector and how industry incumbents can adapt to stay competitive. Let’s take a quick look at what we’ve discussed now.

Exceeding Customer Expectations With Better Digital Experiences

Today’s financial clientele expect a better digital experience — and are willing to switch financial institutions to get it. To remain competitive, financial services providers need to focus on providing cutting-edge services and superior customer experience.

These facts aren’t lost on financial institutions. According to a recent Accenture study, 87% percent of banking executives say the combination of customization and real-time delivery will underpin future competitive advantages. But financial organizations are still in the early stages of adapting to digital: only 38% of organizations prioritize personalization with only 9% prioritizing on-demand delivery.

Providing a Human Touch

The race to adopt a digital-first approach has one big drawback: the loss of the human touch. Any major change in a financial institution’s approach to communication will need to preserve the human element to maintain and build trust with clientele.

Here, technology can help. Financial organizations can preserve an intimate relationship with customers by using data gathered through digital tools. These data can then provide firms with the demographic information needed to discover unmet customer needs, where services can be expanded and more.

Keeping Consumers Financially Literate

According to a study by Raddon Research Insights, when it comes to understanding how to best use their money, more than half of consumers turn to their primary financial institution for information and resources. Providing these resources is beneficial to financial providers, too, as nearly a fifth of learned consumers bring more business to their chosen financial institution.

Financial service providers are well aware of the benefits of providing financial literacy content, but two worries hinder the development of such material. The first concern is legal and regulatory hurdles that hold many institutions back. But, as finance goes increasingly digital, institutions are integrating more compliance professionals with sales and marketing teams. Doing so allows these teams to work in tandem, accelerating the development of consumer and regulatory-friendly educational content and courses.

The second worry, with the quantity and quality of the content produced. Nearly 60% of executives working for asset management companies say too much content is being produced. The same group also claim that the content out there now is not targeted well enough. These are valid concerns, but using digital tools that measure engagement, interest and interact with audiences can provide organizations with the insights they need to refine their content production process and produce work that leads to productive conversations.